Illinois Taxes are too High! And Spending is out of Control!

Consider the tax issues and implications in Illinois:

- Property tax: # 1 of 50 states

- Gas tax: # 2 of 50 states

- Commercial property tax: # 2 of 50 states

- All taxes: # 7 of 50 states

- Growth in home values since 2000 (13%): Last place of 50 states

- Growth in Illinois economy last five years: 2.8%, # 46 versus national average of 10.8%

- Growth in private sector jobs: past few years: # 49 of 50 states

- Loss of businesses since 2021: # 3 of 50 states

And on the spending side:

- Spending on public sector employees is 25% of state budget, highest percentile in USA

- Spending per school student in Midwest: # 1

- Pension debt of $142 Billion is three times larger than the annual state budget

- The city of Chicago has a pension debt of $48 billion, a debt larger than the pension debt of 44 states

- Taxpayer funding of Illegals: $1B for 2024

The implications for adverse impact on the lives of the people of Illinois include:

- High taxes reduce spending opportunities for everyone, both people and businesses

- Potential for improving the quality of life is made more difficult when after tax income is less than what could be earned in other states

- Personal advancement in a career is hindered when job creation by employers is hobbled by a high tax environment

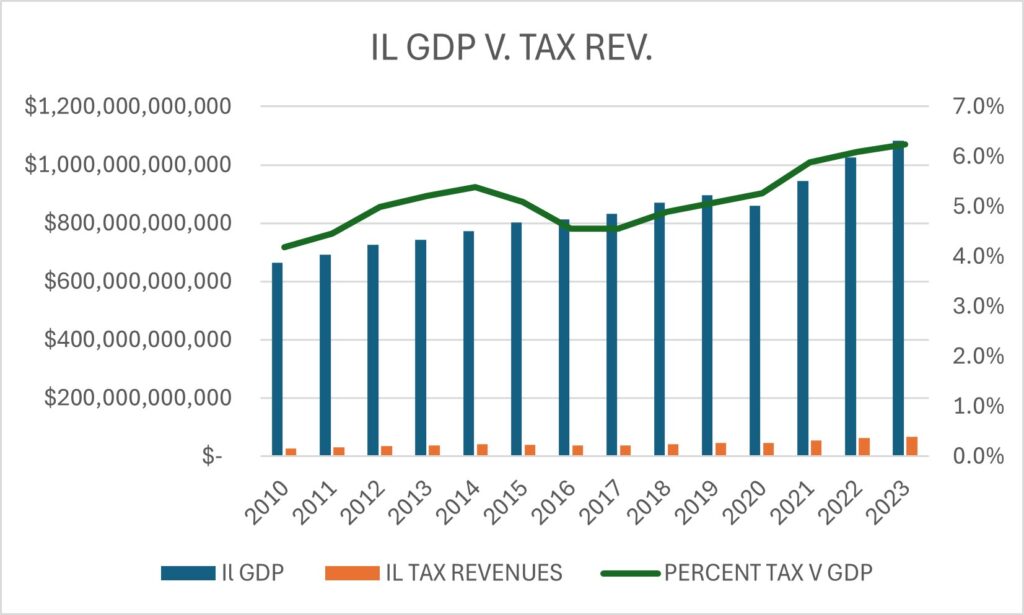

The politicians that run the state of Illinois are fully aware of the decline in state revenues over the past decade, given the loss of people and businesses. Their chosen solution has been to raise taxes, make up the shortfall and maintain spending at all costs, no matter how much debt or erosion of the state economy it causes.

For perspective, the national state level GDP versus state taxes is 5% of revenue. So Illinois has been trending above the national average since 2016, is 1.2% higher than the national average for the most recent year. This translates to approximately $6.7 Billion in excess tax collections in the most recent year.

The federal tax collection is 27.1% of national GDP. All levels of government are consuming about one third of the national economy. Amazing, eh?

We are left with more questions than answers. Where is the political leadership to reduce the costs of Illinois government, get spending in line with revenues, and give the people and businesses of our state the opportunities to thrive and prosper?

Bill Broderick

Note: All data cited for Illinois taxes and economy are derived from Wirepoints publication as well as other trusted IL based resources.